I’ve listened to quite a bit of advice over the past 24 months about how to start a business, some bits more entertaining than others …

“Don’t run out of money. That’s a bad idea.”

“You’ll only get audited if you try and expense things like private jets.”

“People generally have the best intentions and will treat you as such.”

After 24 months out on my own, I can definitely say:

“No shit. Running out of money is very low on my to-do list this week.”

“That’s not true. Federal, state & municipal governments can & will audit you and will gladly add penalties on top for the trouble it caused them.”

“Yes, people have good intentions. Their bank accounts and ‘we’ll make sure to get you next time’ on the other hand, do not. As the great quote goes –‘In god we trust, all others must pay cash'”

Which brings me to the purpose of this blog post …

8 Things to Know Before You Start a Business

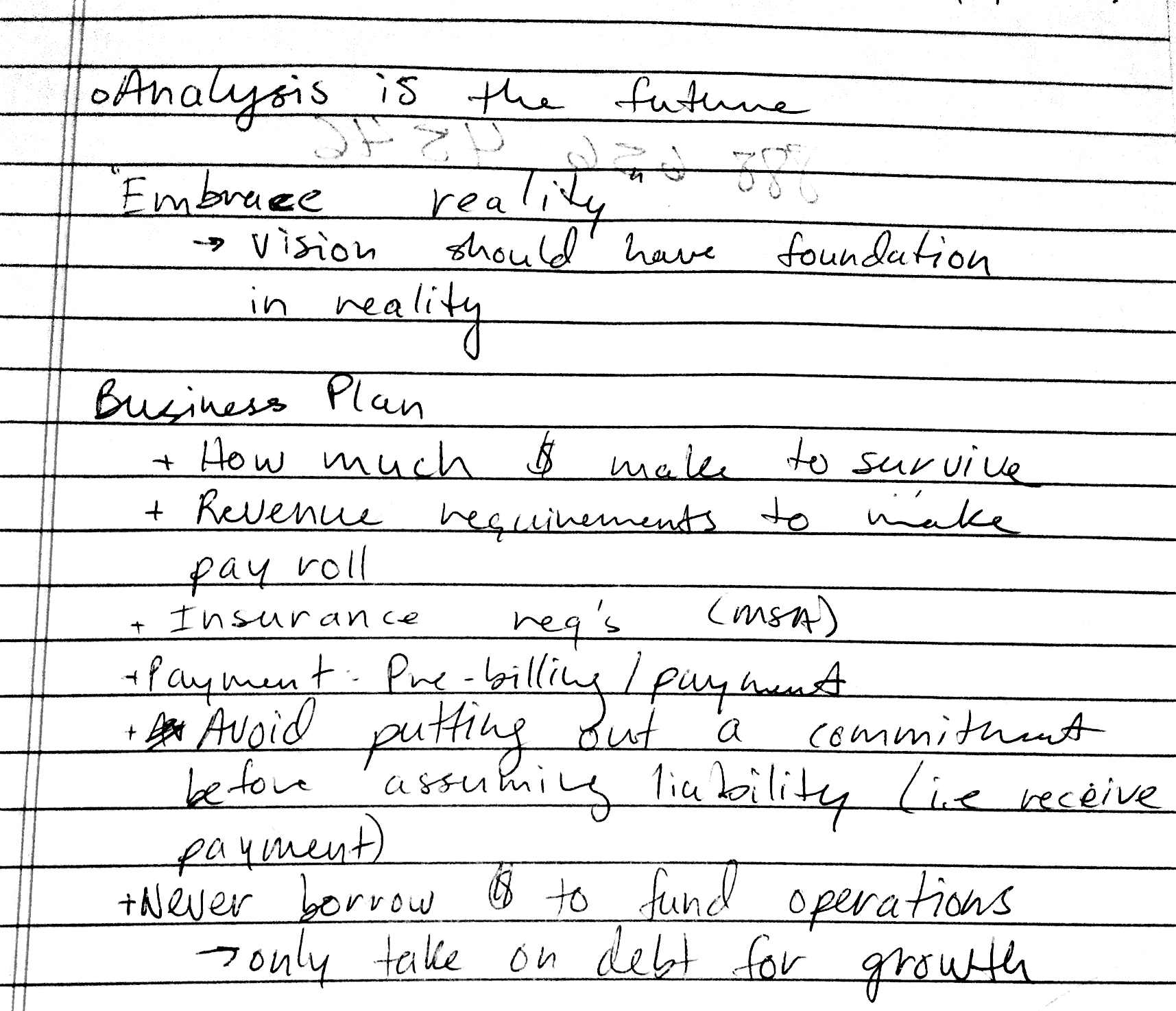

Right after we started our agency & prior to my leaving Seattle, I had the pleasure of sitting down with an esteemed colleague of mine who graced me with some words of wisdom as I set off into the wild blue yonder of start up agency founder & entrepreneur.

The original notes from that conversation are posted in the photo above, but for those who have a hard time reading my chicken scratch, I went ahead and re-wrote them below.

So, without further ado, 8 Things to Know Before You Start a Business:

- Understand the Future: Do a deep dive to understand the work your company will perform to generate revenue. How does that look today? What does it look like a year from now? 5? 10?

- Embrace Reality: The overall ‘vision’ for what your company will do and how that will be accomplished should have a solid foundation in reality

- Understand Burn Rate: Tim Ferris calls it ‘life burn rate’ while other start uppers simply shorten it to ‘burn rate’ … Whatever you call it, understand the dollar amount you personally need to earn to survive

- Revenue Requirements to Make Payroll: Additionally, understand how much money you need to generate each month and in what fashion that revenue needs to make it’s way into your bank account to pay your employees (prepayment? monthly payment? net 30 terms?)

- Insurance: You are operating a business — get some d@&% insurance! As we found out early, our first client (Box) refused to pay us until we could show proper proof of insurance

- Payment: We touched on this above, but it’s worth a second mention … understand how your revenue makes it’s way into your bank account! In total, you may pull in $50k in revenue per month and push out $50k in expenses (breaking even — that’s fine). But if you don’t receive your $50k until the very last day of each month and your expenses are due before that date, you will bounce a lot of checks and piss off literally everybody you do business with

- Avoid Assuming Liability: I can’t say it any better than my advisor in this conversation, so I’ll just quote him, “Avoid putting out a commitment before you assume liability”. In short — get paid or produce a written agreement for payment before performing work!

- Borrow for Growth, not Operations: Never borrow money to fund operations. This shows that you are running an unprofitable business. Instead, borrow money to fund growth. An example? Say you are a software company and if you had 10 more engineers on staff, you could produce 5x the work and generate 15x more revenue from your existing customers. Make sense?

What Other Bits of Advice Do You Have?

Drop me a line in the comments section with additional pieces of advice and I will add them in to this post!

—

Aside from being the CEO at MKG Media Group, Mike is a dark beer aficionado with a healthy appetite for travel and pushing personal boundaries.

A proud graduate of Washington State University, Mike currently calls San Francisco home.